Qualified Charitable Distributions (QCDs)

How are QCDs reported on a tax return?

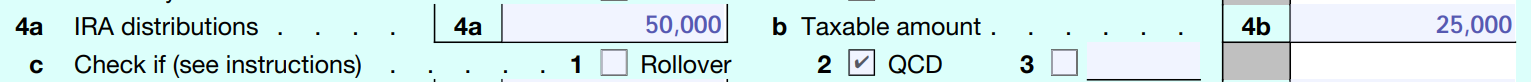

Total IRA Distributions are reported on line 4a of your 1040 tax form. On line 4b, the Taxable Amount is reported, less the value of any QCDs.

*Be sure to enter or check "QCD" next to Line 4b

2025 Example

2024 Example

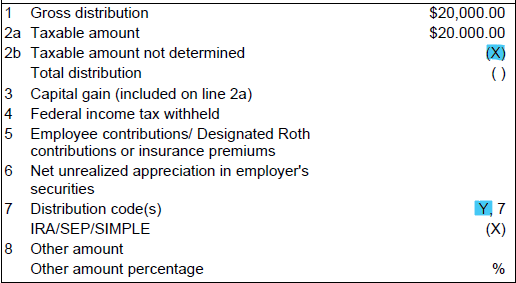

The total IRA Distributions (line 4a) will come from your 1099R. Importantly, QCD amounts may not be specifically identified in the 1099R – these values are self-reported.

Important: Clients may receive multiple 1099R pages — it is important to include all with your Tax Filing. New for 2025, the IRS has included optional distribution code Y, indicating a QCD. Therefore, your documents may look different from last year. You should reference the email provided to you from our staff in January documenting your QCDs for the year.

If you have questions about your documents, please reach out to our office: 972-393-0376

You may have one or both of the pages of the 1099R examples above.

What sort of documentation does Main Street Retirement provide for me?

Near the end of January, if you took a QCD in the preceding tax year, our office will send you a courtesy email with documentation of your QCD transactions. This information can be provided to your tax preparer and kept for your own records. The information will include: the account name and number, amount, and date of distribution(s).

Important: please reference this courtesy email along with all pages of 1099R for Tax Filing.

What is a Qualified Charitable Distribution (QCD)?

We discuss the use of QCDs with clients when we approach Tax Planning in retirement. See the IRS web page on this topic. You are eligible to utilize a QCD once you reach the age of 70-1/2. A QCD can be taken from a Traditional IRA or an Inherited IRA.

QCDs can be especially useful tools once you reach RMD age and are charitably inclined. The proper use of a QCD can not only save income taxes by the exclusion of these distributions from your AGI, but also allow you to take the full Standard Deduction or Itemized Deduction from this lower AGI.